What´s Up, Aimondo? A Current Investor Briefing on the State of Affairs

Inspired by many personal conversations and feedback from investor circles, we are happy to meet the desire for more compact and also more timely information with you. We always strive to strike an ideal balance between detail on the one hand and informative brevity on the other, which is why we are presenting the most important new facts at a glance today.

(already communicated: further sources of information are our investor hotline and the regularly updated information on the website: www.aimondo.ag)

1. Status of Business Performance and Outlook for the Coming Years

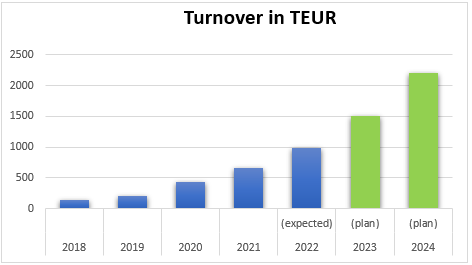

So far, Aimondo has achieved regular growth of about 50% per year and sees the prerequisites given that this rate can be continued with at least 50% growth in 2023 onwards. This is a very positive development in the current economic and market environment.

This means the “exponential growth” expected by the financial markets, especially for start-ups, which increases very quickly to relevant orders of magnitude even with relatively small initial turnovers in the past years and thus forms the basis of the always sought-after “success story” of a young company.

This is exactly what we are successfully working on internationally, both in terms of current new customers, expanding existing customers and our “line-up” for new corporate customers. The fact that the break-even point in our business model has already been reached since mid-2022 will also be very positively received by the financial market. For illustration purposes, the actual and target figures:

Exponential growth at 50% per year is continued

2. Aimondo Further Strengthens Investment in Online Artificial Intelligence

Newly positioned, Aimondo prepares for 2023. Contrary to the pessimism of the IFO and stock market trends, Aimondo is strengthening its outstanding technology position in the e-commerce market. “The reluctance to buy and the unbroken shift from bricks-and-mortar business to online trade are a challenge to the more active part of the business community to expand their market position more energetically and with all their might,” says René Grübel, CEO of Aimondo AG. To this end, new locations have been created, especially for the powerful development of technology.

The current development office in Cyprus will be significantly enlarged to make room for an expanded international group of IT developers in the field of Artificial Intelligence (AI). Especially bright Eastern European minds are now applying for team places in what is probably the most advanced AI squad for business on the internet.

Heinrich Müller, Chief Technology Officer, is pleased to note this: “The brain drain from Russia and other states of the former Soviet Union is really picking up speed right now. Cyprus has been an attractive destination for a young elite from these countries for years”.

Favourable tax legislation, a lower cost of living and state-of-the-art infrastructure have also contributed to the fact that the number of inhabitants has risen from 700,000 to over 1.1 million since 2015.

3. Aimondo Invests and Expands Further in Advisory Services and Marketing

A newly founded subsidiary complements the Aimondo Group; in addition to the focus on “technical development and market support in Germany”, an integrated profit centre with consulting services (“Value Consulting”) is also being created here. This branch was created at the request of many customers who have used Aimondo in the past. Aimondo has developed a lot of know-how as well as data quality and analysis in the correct pricing of consumer goods.

Customer demand for active management support from Aimondo in all types of competitive pricing topics, strategic model implementation and full IT automation of pricing is very high and subject to demanding growth rates. Consulting services are additionally charged to the clients and mean additional value creation. These are now also used by the world market leader for strategic price consulting in this area.

4. Preparation for the Stock Exchange Listing

In the new constellation of the entire Aimondo group, the documentation (“stock exchange prospectus”) for the listing of Aimondo AG is currently being updated, which had already been completed at the end of 2020, but had to be put aside at that time for the reasons already communicated to you of a “suspicion of a pyramid scheme”.

The suspicions of the authorities on Aimondo (here Aimondo GmbH, Düsseldorf) will soon turn out to be what they are: completely false and groundless!

In recent months, the Aimondo Group has effectively countered this obstruction, which, in addition to the actual and demanding daily business, has become an enormous additional expense, massively hindering the daily business as well as significantly slowing down the exponential growth – despite the annual 50%. The listing application for Nasdaq Nordic will now be submitted as quickly as possible; it is advisable in any case to include the consolidated financial statements for 2022 and then to carry out the actual IPO in the first half of 2023.

This clears the way for international expansion – initially into the economically strongest countries with the right economic momentum. The professional skills in the team, the technical avant-garde combined with the hardest work, perseverance and experience, are now paying off.

5. Last but not Least:

In connection with the new time horizon for the listing, it should be added: There are direct, pre-market OTC (“Over The Counter”) offers for the Aimondo preferred shares by the Aimondo AG founding shareholder (TTIP Limited) and the Family & Friends (F&F) circle (no public offering – limited purchase rights for members only). In return, bonds can still be issued against preference shares under the direct F&F programme ((no public offer – limited purchase rights only for members and original bond subscribers of Aimondo GmbH).), as described in the last Infoletter, without additional payment and at excellent conditions.

Back to NewsReady to start?

Click here to get to the product site